Higher education is expensive. Engineering, medical, management, or even regular graduation courses now require significant financial planning. To reduce this burden, the Bihar Student Credit Card scheme was launched by the Government of Bihar under its youth empowerment initiative.

If you are planning to pursue higher studies and want financial support, this detailed guide explains everything from bihar student credit card eligibility to bihar student credit card login, approved college list, interest rate, age limit, and how to check application status.

Let’s understand it step by step.

What is Bihar Student Credit Card Scheme?

The bihar student credit card scheme (BSCC) is a state government initiative that provides education loans of up to ₹4 lakh to eligible students for higher education.

The scheme aims to:

- Increase higher education enrollment

- Support economically weaker families

- Reduce dropouts due to financial constraints

- Promote technical and professional education

Loan Amount and Coverage

Under the Bihar Student Credit Card scheme, students can receive:

- Up to ₹4,00,000 loan

- Tuition and admission fees

- Books and study materials

- Laptop (if required for course)

- Hostel and mess expenses

- Examination fees

This makes it easier for students to complete their education without depending entirely on private loans.

Bihar Student Credit Card Eligibility

Before you apply, make sure you meet the bihar student credit card eligibility criteria:

1. Domicile

- Applicant must be a permanent resident of Bihar.

2. Educational Qualification

- Must have passed 12th (Intermediate) from a recognized board.

- Must have secured admission in a recognized institution.

3. Recognized Institutions

The course and college must be approved by regulatory bodies like UGC, AICTE, or other statutory authorities.

4. Bihar Student Credit Card Age Limit

The bihar student credit card age limit is:

- Maximum 25 years at the time of application.

Always verify updated eligibility rules on the official portal before applying.

Bihar Student Credit Card Course List

The scheme supports a wide range of higher education programs. The official bihar student credit card course list includes:

- Graduation (BA, BSc, BCom)

- Engineering (B.Tech, BE)

- Medical (MBBS, BDS)

- Polytechnic

- MBA and Management courses

- Law programs

- Professional and technical courses

- Skill-based higher education programs

Students should confirm whether their course is included before submitting the application.

Also Read: BCA Course: Full Details, Eligibility, Syllabus, Fees, Salary & Career Scope

Bihar Student Credit Card College List

One of the most searched queries is about the bihar student credit card college list.

The scheme supports:

- Government colleges

- Recognized private colleges

- Technical institutions

- Professional institutes approved by regulatory bodies

Instead of relying on unofficial lists, students must verify their institution’s approval status through:

- Official scheme portal

- Regulatory authority websites (UGC, AICTE, NMC, etc.)

If your college is not recognized, the application may be rejected.

Bihar Student Credit Card Interest Rate

The bihar student credit card interest rate is one of the most attractive features of the scheme.

- 4% simple interest per year

- 1% simple interest for:

- Female students

- Transgender applicants

- Divyang (PwD) students

(Source: Official Bihar Government guidelines)

Compared to regular bank education loans that often charge 8–12% interest, this scheme is significantly more affordable.

Moratorium & Repayment Terms

The repayment begins after:

- Completion of the course

OR - 1 year after getting employment

(Whichever is earlier)

The repayment period can extend up to 15 years, reducing financial pressure on fresh graduates.

Remember, this is a loan not a scholarship. Timely repayment is important.

How to Apply: Bihar Student Credit Card Apply Process

If you are wondering how to complete the bihar student credit card apply process, here is the step-by-step guide:

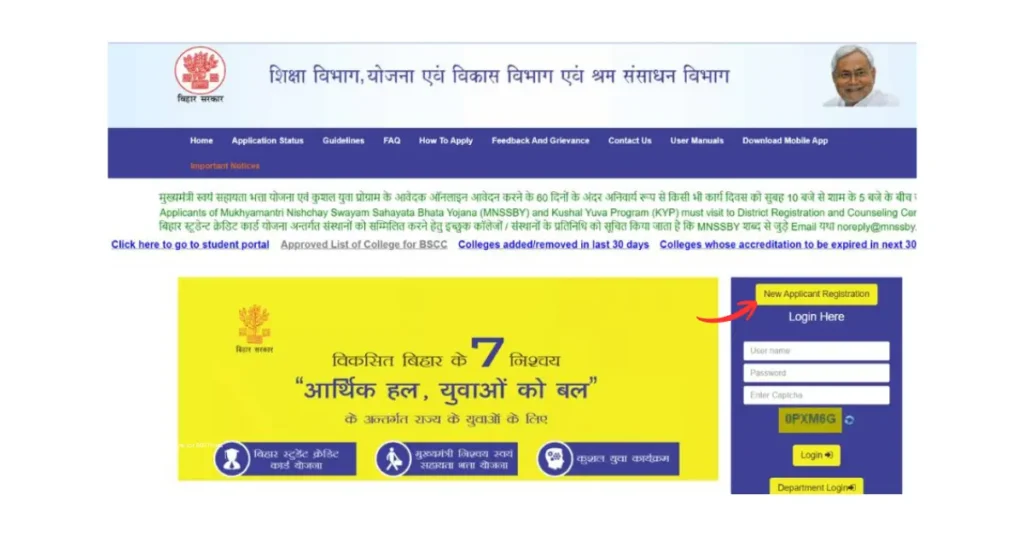

Step 1: Online Registration

Visit the official portal:

https://www.7nishchay-yuvaupmission.bihar.gov.in

Step 2: Create Account

- Click on New Applicant Registration

- Enter personal details

- Verify using OTP

Step 3: Fill Application Form

- Select Bihar Student Credit Card scheme

- Enter educational and financial details

- Upload required documents

Step 4: Submit and Track

- Submit the form

- Keep the acknowledgment number

After submission, you will be called to the District Registration and Counseling Center (DRCC) for verification.

Bihar Student Credit Card Login Process

For tracking and updates, students must use the bihar student credit card login feature on the official portal.

Steps:

- Visit the official website

- Click on Login

- Enter registered mobile number/email

- Enter password

- Access dashboard

Through login, students can:

- Edit application (if allowed)

- Upload additional documents

- Check approval progress

How to Check Bihar Student Credit Card Status

Applicants often search for bihar student credit card status updates after submission.

To check status:

- Visit official portal

- Use login credentials

- Check application tracking section

You may also receive SMS notifications regarding verification or approval.

If the application is pending for long, you can contact the district DRCC office.

Documents Required

Before applying, keep these ready:

- Aadhaar card

- 10th & 12th mark sheets

- Admission letter

- Fee structure

- Domicile certificate

- Income certificate

- Passport-size photographs

- Bank account details

Incomplete documentation is one of the main reasons for delay.

Bihar Student Credit Card Helpline Number

If you face technical or application-related issues, you can contact the official support system.

The bihar student credit card helpline number is available on the official 7 Nischay portal under the contact section.

Always rely on the official website for updated helpline details. Avoid third-party numbers found on random websites.

Difference Between BSCC and Regular Bank Education Loan

| Feature | Bihar Student Credit Card | Regular Bank Loan |

|---|---|---|

| Loan Amount | Up to ₹4 lakh | Varies |

| Interest Rate | 4% (1% special cases) | 8–12% approx |

| Collateral | Not required | Sometimes required |

| State Support | Yes | No |

| Target Beneficiaries | Bihar students | General applicants |

The scheme is more accessible and affordable for Bihar residents.

Common Reasons for Application Rejection

- Non-recognized institution

- Age above limit

- Incorrect documents

- Incomplete application

- Domicile mismatch

Double-check eligibility before applying.

Who Should Consider This Scheme?

You should apply if:

- You are a Bihar resident

- You secured admission in higher education

- Your family faces financial constraints

- You want low-interest education financing

The scheme works best for students who need structured financial support without heavy bank interest.

My Personal Experience with the Bihar Student Credit Card Scheme

While researching and guiding students about the Bihar Student Credit Card scheme, I interacted with several applicants who successfully completed the process. One common pattern I noticed was that students who carefully checked eligibility criteria and kept their documents ready faced fewer delays.

In one case, a student applying for a B.Tech course initially faced rejection because the uploaded income certificate was outdated. After updating the document and revisiting the DRCC office for verification, the application moved smoothly. This experience highlights how important accuracy and patience are during the process.

Another important lesson I observed is that students who regularly used the bihar student credit card login portal to track their bihar student credit card status stayed better informed and avoided unnecessary confusion.

From these interactions, my biggest takeaway is simple: the scheme genuinely helps deserving students, but it requires responsibility. Treat it as a serious financial commitment, not free money. If you understand the terms, plan repayment early, and follow official guidelines, the Bihar Student Credit Card can truly support your higher education journey without overwhelming your family financially.

Final Thoughts

The Bihar Student Credit Card initiative is one of the most student-focused financial support programs introduced by the Government of Bihar. It balances accessibility with responsibility.

Low interest rate.

No collateral.

Long repayment period.

But remember this is still a loan. Use it wisely, plan repayment carefully, and stay updated through the official portal.

For the latest updates, always visit:

https://www.7nishchay-yuvaupmission.bihar.gov.in

References

To ensure accuracy and reliability, the information in this article is based on official government sources and regulatory authorities:

- 7 Nischay Yuva Upmission Portal – Official Bihar Student Credit Card Portal

Managed by the Government of Bihar

https://www.7nishchay-yuvaupmission.bihar.gov.in - Education Department, Government of Bihar

https://state.bihar.gov.in/educationbihar - University Grants Commission (UGC) – Recognition of Universities & Colleges

University Grants Commission

https://www.ugc.gov.in - All India Council for Technical Education (AICTE) – Approved Technical Institutions

All India Council for Technical Education

https://www.aicte-india.org - Official Scheme Guidelines & Notifications released by the Bihar Government under the Youth Welfare Initiatives (Mukhyamantri Nishchay programs).

Hi, I’m Rajesh Rana, a Computer Trainer and the founder of

Rana Computer Institute. I teach practical, job-oriented courses like

DCA, ADCA, Tally Prime,

Web Development, and Digital Marketing.

My goal is to explain computer concepts in a simple way so students can confidently use

these skills in real life, jobs, and online work.